It is

specified that this should cover all legal cases open at 31 December 20X1, in

addition to those settled or closed in the year. In addition, a contingent liability for USD

3,000,000 was disclosed in the notes to the financial statements (Case 4). A provision is reversed, either partially

or in full, when it is no longer required. This differs from adjustments to

provisions described in section 3.1.4 below, as reversals involve derecognition

of all or part of a provision (i.e. they no longer meet the provisions

recognition criteria).

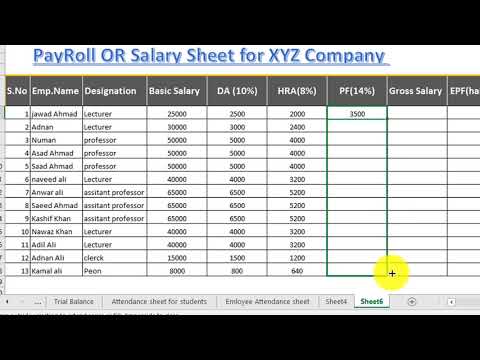

In financial accounting under International Financial Reporting Standards (IFRS), a provision is an account that records a present liability of an entity. The recording of the liability in the entity’s balance sheet is matched to an appropriate expense account on the entity’s income statement. In U.S. Generally Accepted Accounting Principles (U.S. GAAP), a provision is an expense. At 31 December 20X1, both cases are deemed to have met the

provisions recognition criteria. As no provision exists in the financial

statements for these two cases, two new provisions should be recognized in the

statement of financial position, for USD 3 million and USD 10 million

respectively.

Global sustainability standards

If an outflow is not probable, the item is treated as a contingent liability. When you create an expense with Debitoor offers a ‘bad debt’ category for expenses, where you can record provisions for lost income. With our larger plans, you can also enter and track depreciation of assets. A loan loss provision is defined as an expense set aside by a company as an allowance for any unpaid debt meaning loan repayments that are due and are not paid for by a borrower. A provision is recorded in a liability account, which is typically classified on the balance sheet as a current liability. The accounting staff should regularly review the status of all recognized provisions, to see if they should be adjusted.

- IAS 37 defines and specifies the accounting for and disclosure of provisions, contingent liabilities, and contingent assets.

- A contingent liability will then be

disclosed for the possible outflow of USD 2 million. - A credit transaction occurs when an entity purchases merchandise or services from another but does not pay immediately.

- The obligation may not be present due to the uncertainty of future events, or the uncertainty may make it impossible to determine if or how many economic resources will be outflowing in the future.

- It is beneficial for banks to have a high PCR to protect themselves against losses when NPAs start increasing rapidly.

Purpose of creation of General reserve is to strengthen the financial position of the company and to increase the working capital. A crucial difference between provisions and accrued charges is the position of certainty. Vittles are for probable future charges where there’s a query about when they will be paid or how important will actually be spent. In discrepancy, an accrued expenditure is one that the company knows with certainty.

IAS 37 — Provisions, Contingent Liabilities and Contingent Assets

In the Property, Plant, and Equipment chapter, we briefly discussed the accounting treatment of decommissioning and site restoration costs. The general approach is to capitalize these costs as part of the asset’s carrying value and report an obligation, sometimes referred to as an asset retirement obligation. Reserve is an appropriation of profits; on the other hand, Provision is a charge against profit. Reserves are not meant to meet out contingencies or liabilities of a business. Reserve increases working capital of a company to strengthen the financial position.

You can consent to processing for these purposes configuring your preferences below. Please note that some information might still be retained by your browser as it’s required for the site to function. Since the 2008 Global Financial Crisis, lending regulations for banks were restricted in order to attract higher credit quality borrowers with high capital liquidity. Despite such regulatory improvements, banks still need to take into account loan defaults and the expenses for loan origination. When it comes to assets, it is deducted from the purchase, but when it comes to liabilities, it is shown as a liability.

For illustration, a company that guarantees its products knows, grounded on literal data, that it’s likely to face form or relief costs for a chance of the products vending in a specific period. By including a provision for those costs during the same period as the products are vented, the company can more directly match its charges and profit for the period, therefore presenting a clearer view of profitability. Corporate tax provision software incorporates automation and other technologies that can speed your tax provisioning calculation in several ways. The right tax provision software helps eliminate errors and streamline your tax calculation processes so you can complete filing obligations easily. Tax provision software delivers the tools to help you respond to regulatory changes around the world in nearly any jurisdiction. Tax departments are reporting up to 50% faster processing with some tax provision software, along with other improved results.

Contingent Assets

However, it is possible that some of the outstanding debts will not be fully repaid, for such provision will be created up to the loss proportion. Deprecation is a system of accounting for an asset’s decline in value over time. A deprecation provision represents the deprecation during the current account period. A duty provision is a plutocrat set away to pay the company’s estimated income levies. Provisions enable companies to gain a more accurate assessment of their fiscal position. This helps them shape better business opinions and gives shareholders a clear picture of their finances.

seminar «Cost Audit, Procedures, Compliance and Impact of … — Ten News

seminar «Cost Audit, Procedures, Compliance and Impact of ….

Posted: Mon, 04 Sep 2023 16:50:42 GMT [source]

If depreciation is present in the financial statement, it is more accurate to state the asset’s value in the report. A reserve, or reserve fund, is money allocated from profit for a specific purpose. It can also be concluded from the above that sums set aside to meet known liabilities, of which the amount can be ascertained accurately, should be treated as accruals or accrued liabilities and not provisions. Similarly, the amount used out of profits for the redemption of preference shares and transferred to the capital redemption reserve can be used only for the issuance of fully paid bonus shares. Capital profits that arise because of the revaluation of fixed assets cannot be distributed as dividends among shareholders. However, the meanings of these two terms were clarified considerably in the Companies Act.

Thus, to decide anything, it is important to study the need and requirement of a firm according to the financial position of a firm. Therefore, investment in outside securities is justified only in a case where company has the extra fund to invest. These are some of the considerations for determining whether an implicit fiscal obligation should be treated as a provision. Provisions can be found in the laws of a country, in loan documents, and in investment-grade bonds and stocks. For example, the anti-greenmail provision contained within some companies’ charters protects shareholders from the board passing stock buybacks.

Summary of IPSAS Accounting Policy

Capital Reserve – The capital reserve is a profit-saving accounting method. A capital reserve is created when long-term assets are sold or liabilities are settled. It excludes any unallocated funds that may be utilised to distribute earnings. For the purpose can i capitalise my lease or not to repay of any liabilities or to replace any fixed assets after particular period, sinking funds are created. For this, some amount are charged or appropriated from the profit and loss account every year and invested in any outside securities.

We do this because the quality of implementation and application of the Standards affects the benefits that investors receive from having a single set of global standards. The IFRS Foundation is a not-for-profit, public interest organisation established to develop high-quality, understandable, enforceable and globally accepted accounting and sustainability disclosure standards. When you access this website or use any of our mobile applications we may automatically collect information such as standard details and identifiers for statistics or marketing purposes.

Resources for Your Growing Business

Banks and other lenders may establish loan loss vittles to regard uncollected loan stars and payments. Loan loss vittles can be used to cover insolvencies, loan defaults, and reasoned loans that affect entering lower payments than first estimated. A bad debt provision is an estimate of the quantum of accounts delinquent that won’t be collected.

It can be an independent entity, a branch of a parent company, etc., And the nature of the business it’s involved in. Capital profits are generally not available for distribution by way of dividends among the company’s shareholders. Examples of such reserves are the Dividend Equalization Reserve (i.e., a reserve created to maintain equilibrium in dividends) and the Debentures Redemption Reserve (i.e. a reserve created for the redemption of debentures). A reserve fund is a reserve against which there is a clearly earmarked investment outside the business. Thus, if the amount of the reserve is being used by the business itself, it cannot be called a reserve fund.

The recording of provisions occurs when a company files an expense in the income statement and, consequently, records a liability on the balance sheet. Typically, provisions are recorded as bad debt, sales allowances, or inventory obsolescence. They appear on the company’s balance sheet under the current liabilities section of the liabilities account. The cost of depreciation and restructuring payments are among the expenses businesses face in any accounting year.

Chapter 15 — Provisions, Contingent Liabilities and Contingent Assets

Provisions are finances set away by a business to cover specific awaited future charges or other financial impacts. An illustration of a provision is the estimated loss in value of force due to agelessness. Companies elect to make them for future obligations whose specific amount or date of incurrence is unknown. The provisions basically act like a hedge against possible losses that would impact business operations. It can be estimated well ahead of time, and money can be set aside for it in a very specific fashion. The accrued expense is listed in the ledger until payment is actually distributed to the shareholders.