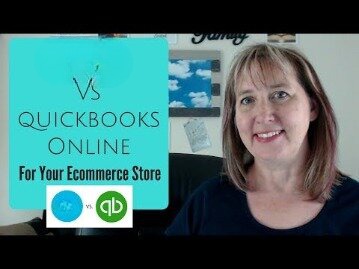

At Business.org, our research is meant to offer general product and service recommendations. We don’t guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services. But, if you are from the rest of the 36 states, then you have to pay $20 per month, and there is also a fee for each user. If you are curious about this payroll processing software, go through this article. This makes Wave unable to handle taxes in countries like Australia where prices must be quoted inclusive of all taxes such as GST.

It is not easily accessible I.e wave payroll don’t have an app that work on Andriod and IOS devices. We built our Payroll tool for small business owners, so it’s easy to use AND teaches you as you go. Your employees can log into Wave securely to access their pay stubs and T4s, and manage their contact and banking information. No worries—just check out our list of the year’s best payroll companies for small businesses. Finally, if you use Wave Payroll, you can only access customer service via live chat on weekdays or via email. Wave doesn’t have any over-the-phone support, so if you run into technical problems on a weekend, expect to deal with them on your own.

That’s right, you can balance your books and generate invoices at no additional cost. And luckily, these other tools are similarly user-friendly and visually stunning. G2 shows more than 25 customer reviews of Wave Payroll with an average rating of 4.1 out of 5 stars. Positive reviewers noted the platform’s easy-to-use integrations and simplified payroll processes. Some negative points mentioned are the two-step process of paying 1099 contractors and the lack of international payrolls. Wave Financial Inc. is an accredited business with the Better Business Bureau and has an A rating from the company.

Tax payments and filing

Employees can use self-service accounts to view pay stubs, updated information and access tax forms. We were actually able to get everything set-up in 4 hours, not missing a beat, employees were paid on time and reporting cash in — cash out doesn’t require a degree from MIT. We provide different levels of support for customers who use different features and services from Wave.

- The platform lacks advanced abilities, like talent and performance management and advanced data analytics.

- Many or all of the products featured here are from our partners who compensate us.

- On this last page, you can also start the process of «offboarding» an employee (resignations or dismissals) or place them on leave.

- Not to mention the stress of worrying about making errors and winding up in a tax audit (yikes!).

- Pricing for Wave Payroll is a bit different in that you pay either $20 or $35 per month as a base payment, depending on the state in which you’re running payroll.

Unlike Wave Payroll which has limited HR functionalities, Gusto offers a more comprehensive suite. This array includes performance management, time-tracking and tools for employee onboarding. Plus, the competitor supports global operations beyond the U.S. and Canada. While Wave Payroll nails payroll basics, businesses seeking a more comprehensive HR solution might feel underwhelmed.

Wave Payroll pricing starts at $20/month + $6 per person paid for its self-service payroll plan. If you’re looking for free payroll software, check out our post, The Best Free Payroll Software For Businesses, to see our top free payroll software picks. More specifically, Wave Payments pricing starts at 2.9% + $0.60 per credit card transaction and 1% per transaction for AHC payments. If your business needs tax, bookkeeping, or accounting advisory services, Wave Advisor will provide them at a starting price of $149/month.

This beautiful approach is invaluable for small-business owners who might not be payroll experts. The point-and-click interface is structured so that even novices can dish out paychecks stress-free. Wave Payroll has a ‘great’ User Satisfaction Rating of 82% when considering 116 user reviews from 2 recognized software review sites. Wave Payroll doesn’t offer much for benefits administration; you won’t be able to handle anything beyond worker’s compensation benefits through Next Insurance within the platform. Robie Ann Ferrer is payroll and HR expert at Fit Small Business, focusing on software. Prior to becoming a writer, she worked as an HR specialist at several multinational companies.

On the contrary, it’s a great payroll software for businesses with basic payroll needs. Additionally, Wave is perfect for small businesses already using Wave products or businesses looking to integrate simple accounting software with payroll software. Wave Payroll also has a dashboard where you can see important payroll and tax filing dates, including holidays. If you’ve yet to set up your direct deposits, a task reminder will appear on the dashboard that includes a link to the system’s direct deposit setup page. Both packages come with the same payroll features, like multiple pay schedules, free direct deposits, paid time off (PTO) accruals, employee self-service tools, and tax payment reminders. Wave Payroll is meant for small businesses and startups that have a fluctuating roster of employees and contractors.

Customizable payroll schedules

The employees can easily fill out their information and complete the portal. Even the pay stubs and tax stubs will be easy for them to view. Wave is a company that provides financial services and software for small businesses. Wave is headquartered in the East Bayfront neighborhood in Toronto, Canada.

Wave Payroll is a middle-of-the-road payroll solution that works best for current Wave Accounting users. With all of the things automated in the payroll process, businesses often end up paying more than what their budget can afford. However you must manually apply the tax for every transaction as they come in, there is no way to automate it.

While the software provides just enough features to run payroll, there are so many basic features missing that you’d expect from payroll processing software. However, some of Wave Payroll’s online tools, while simple, take more steps or clicks than with other payroll software. It may have an online help center you can access 24/7, but not all of the articles contain step-by-step details. And while you can hire a Wave Advisor, this service costs extra (custom-priced), and you only get assistance in completing and filing business or personal taxes. Wave Payroll may have limited HR features, but its solutions are sufficient enough to help small businesses manage very basic HR tasks, such as time sheets and new hire reporting. It even has a simple employee database that contains your workers’ basic information, salary and tax details, PTO balances, and benefits deductions.

What Users Think About Wave Payroll

If you live in a state where automatic tax filing is unavailable, you’ll be able to export the appropriate forms and go through the process manually. SurePayroll is an affordable and straightforward payroll software that offers automatic payroll runs, tax filing, and exceptional customer service. Wave Payrolls allows users to choose and shift between manual and automated payroll processing, thereby managing their costs.

- Wave Payroll may have limited HR features, but its solutions are sufficient enough to help small businesses manage very basic HR tasks, such as time sheets and new hire reporting.

- If you like it, you provide your payment info then and you’ll pay monthly to use the software.

- There’s also a “Review this payroll” button that can give you a glance of your current payroll and the total payroll amount.

While Wave Payroll’s features are pretty basic, its employee status option is a great perk. This is particularly true if you have seasonal or occasional employees and independent contractors that you pay sporadically. You can change their status from active to inactive and only run payroll for them when you need to. Customers like Wave Payroll’s simple interface and say it’s easy for those without accounting experience to run payroll. They’ve also commented on the automatic generation of tax forms being a handy feature.

In these areas, Wave calculates your tax liability for you, though you still need to submit your tax paperwork manually. Our unbiased reviews and content are supported in part by affiliate partnerships, and we adhere to strict guidelines to preserve editorial integrity. The editorial content on this page is not provided by any of the companies mentioned and has not been reviewed, approved or otherwise endorsed by any of these entities.

Wave Payroll vs. OnPay

If you need to make any changes to the displayed payroll, you’ll need to delete the current payroll in order to enter any changes. A complete review of Is Bookkeeping Hard to Learn All your Questions Answered, including pricing, comparisons to competitors, and frequently asked questions. Responses are not provided or commissioned by the vendor or bank advertiser.

The automated tax filing options are exclusive to some states only. The software excels in the features it offers, with the direct deposit service and employee self-service portal being of particular acclaim among users. Many customers found Wave Payroll to be significantly user-friendly and intuitive, while others extolled the high-quality customer service provided by Wave Financial.

Invoicing by Wave is an offshoot of the company’s earlier accounting tools. You create records for your team members first, and then move on to supply information about your business. A sliding bar at the top of the page shows you where you are in the entire process. Payroll by Wave, available as a standalone payroll website or an integrated element of the Wave accounting suite, has been slow to mature and has drawbacks that make it hard to recommend. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Additional Wave Payroll features

Check out our handy support article to learn how you can switch to using Wave’s payroll feature. In general, though, customers are satisfied with Wave’s products and customer support. The payroll software complies with federal and state-level payroll regulations. Automatic tax filing is exclusively available to only 14 of the US states. Employers have access to a timesheet, allowing them to keep track of their hourly-salaried workers. This feature is exclusive to employers alone, and employees cannot fill out the information on this sheet.

Wave Payroll users must submit payroll at least four business days before their employees and contractors are due to be paid. Generally, the cut-off for on-time payroll payments is Tuesday at 3 PM EST. Wave Payroll is a simple payroll solution for small businesses. Businesses can efficiently run payroll, manage employee timesheets, handle deductions, onboard new employees, and much more within the software. If your business is located in a state not covered by its tax services, Wave Payroll will calculate the applicable tax deductions from your employees’ pay.